Key Capital Markets Trends to Watch in 2025

As we move deeper into 2025, what trends are likely to be at the forefront, shaping the capital markets? To address this question and reflect on key moments of 2024, GlobalCapital recently issued a special report: GlobalCapital's Review 2024 | Outlook 2025.

As part of the insightful publication GlobalCapital interviewed Satyam Kancharla, Executive Vice President and Chief Product Officer at Numerix, to get his take on key trends to watch 2025 and how changing market dynamics impact analytics requirements. In today’s blog, we give highlights of that discussion. Read the full article for further detail on Satyam’s perspective, Analytics Key as Economic Uncertainty Looms in 2025.

Interest rate movements, inflation trends and their impact on fixed income

With central banks changing rate regimes, there seems to be a consensus that the period of higher inflation has passed. A new US administration has created market optimism on a favorable regulatory and fiscal environment. Additionally, the recent US election did not introduce much volatility, nor was there much interruption with ongoing and newly escalating geopolitical conflicts, which points to a resilient market. However, Satyam feels this could change in 2025, especially with new tariffs and tax reductions in the US, which could dramatically change global trade dynamics and lead to further inflation and volatility, especially in fixed income markets.

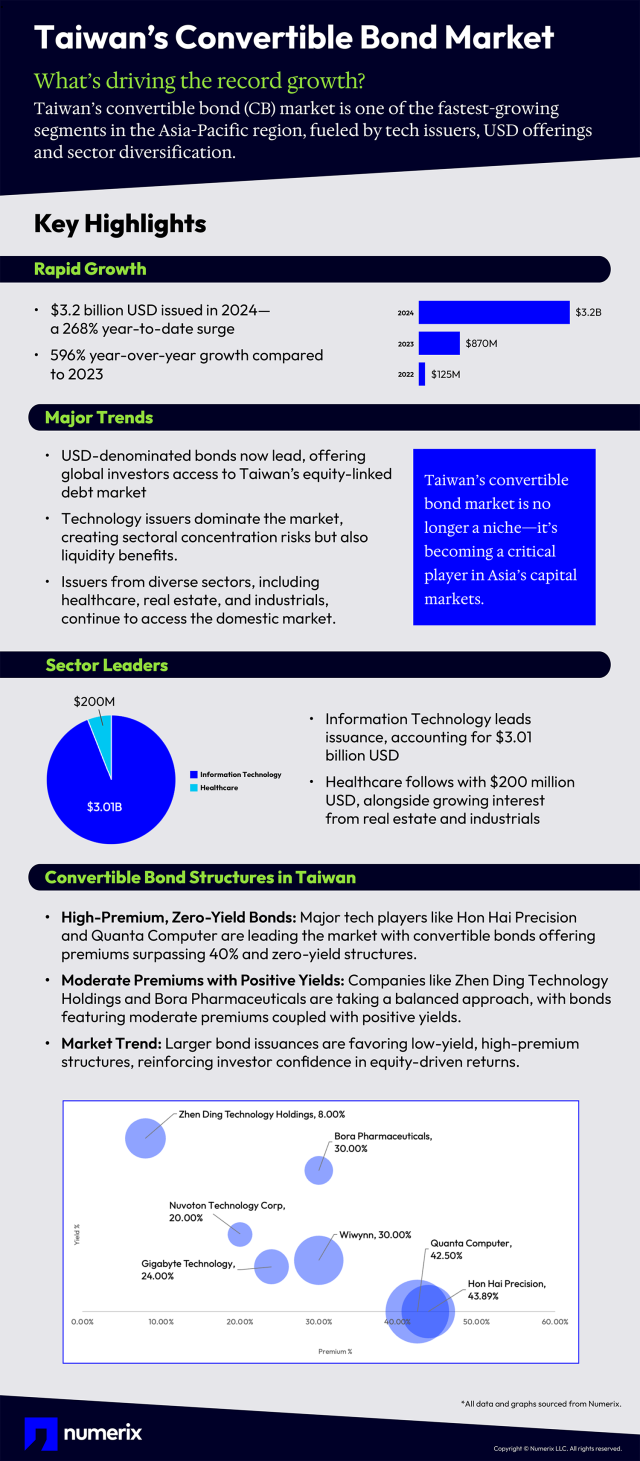

Across the bond market it would be reasonable to expect a strong year ahead. The higher interest rate environment has been particularly beneficial to the convertible market. Companies have been more willing to issue convertible securities to pay lower coupons rather than issuing debt in the high yield market. From an investor’s standpoint, the option embedded in the convertible market offsets some of the interest rate risk compared to fixed income securities.

Role of analytics and technology in adapting to market volatility

Regardless of whether volatility falls or rises in 2025, there is a growing focus on identifying alpha returns with systematic credit strategies. These strategies are data driven approaches to evaluating pricing, where the scope of analytics requirements has become more rigorous, and the latency demands have shifted closer to real-time. This trend indicates a continued push toward efficient data and analytics processes that can be scaled horizontally and vertically. In this regard, flexible cloud scaling is something Satyam expects to continue in 2025. “If we see high volatility regimes, we believe that advanced analytics for stress testing and scenario analysis will be especially important,” he commented.

Traders will want to analyze their portfolios with shifts in multiple risk factors simultaneously to provide key insights into how they will react to market changes so they can hedge or rebalance positions appropriately. Market volatility is particularly important in the convertible market, where volatility is a key driver for convertible valuations.

Innovations and trends for 2025

In the convertible market specifically, new issuance has continued to be strong despite the Fed rate cuts which began in September 2024, and we’ve seen an increase in the number of investment grade companies issuing convertibles. Satyam mentioned that one trend he’s keeping an eye on is the 119 convertible securities that are maturing in 2025, which have a market value of approximately $58 billion.

Most of these bonds were issued in the record setting year of 2020 during the COVID pandemic when companies were trying to secure capital. The expectation is for companies to either exchange or issue new debt to replace these securities. “From a technology perspective, Numerix is continuing to monitor advances in AI and machine learning and exploring how to provide value to practitioners in the marketplace. The Numerix team is also watching the continuing electronification of the fixed income markets and advances in structured credit trading, so we can help our clients stay on the forefront of these trends,” said Satyam.

Read the full article for additional detail on Satyam’s perspective on what market participants can expect in 2025, Analytics Key as Economic Uncertainty Looms in 2025.