Tracking the Surge in Taiwan’s Convertible Bond (CB) Market

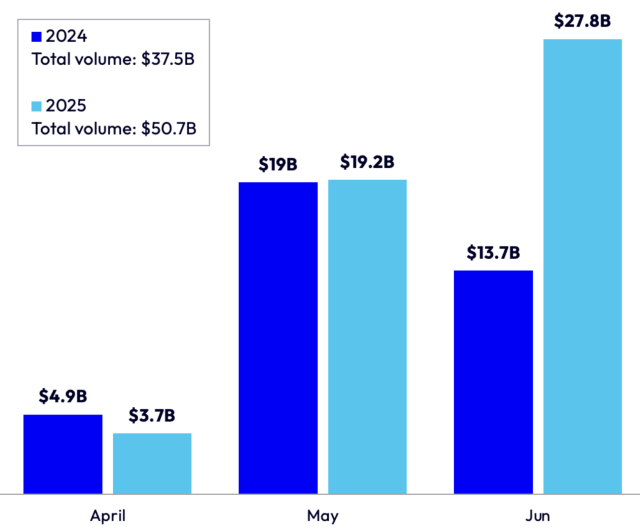

In recent years, the Taiwanese convertible bond (CB) market has experienced a surge in USD-denominated issuances, making it one of the fastest-growing segments in the Asia-Pacific region. As issuers explore alternative financing and hedge funds refine convertible arbitrage strategies, Taiwan’s CB market is on track to becoming an increasingly significant player. Our infographic below highlights the key factors driving this remarkable growth.

Market Outlook

Taiwan’s convertible bond market is evolving into a compelling force in global financial strategy, marked by its adaptability and growing appeal across diverse sectors. With a robust $150 million in new convertible bond issuance kicking off 2025, the market signals sustained demand for flexible funding solutions. The introduction of bonds maturing in 2030 underscores issuer confidence in long-term market stability, while economic factors like interest rates and inflation continue to shape opportunities for arbitrage and relative value strategies.

While technology firms remain the dominant issuers, the emergence of new sectoral players illustrates the market’s expanding horizons. For arbitrage traders, portfolio managers, and risk specialists, Taiwan’s CB market offers a dynamic combination of increasing liquidity, heightened conversion premiums for U.S. denominated issuances, and strategic potential—this market is poised to play an increasingly critical role in global CB trading strategies.

For a deeper dive into this topic, see our recently published white paper: Taiwan’s Convertible Bond Market: A Rising Force in Asia