white paper

Zero-Day Options: Unique Market Dynamics and Risk Considerations

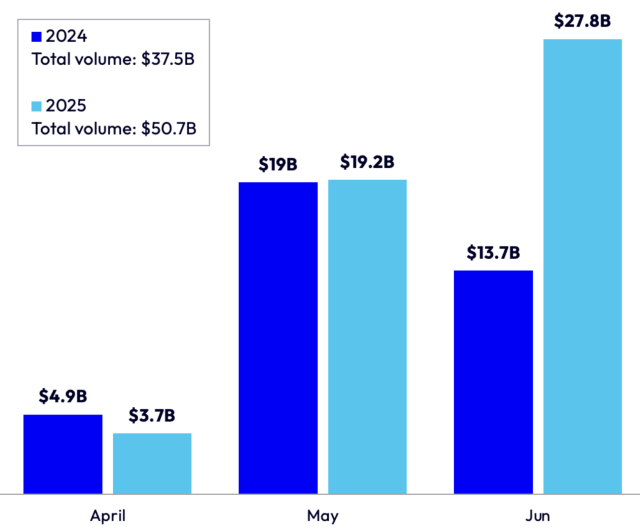

Zero-day-to-expiry (0DTE) options have become a significant and controversial part of the derivatives market – especially as their trading volumes have exploded over the past two years.

To explore the pricing and risk nuances of zero-day options, Risk.net held a webinar featuring a panel of financial market experts. Download the new white paper to learn the themes that emerged from this insightful discussion, including:

- The growth and usage of 0DTE options

- Challenges in modelling their prices and risks

- Practical risk management issues

- Whether 0DTE options pose systemic risks to the market