Begin your exploration

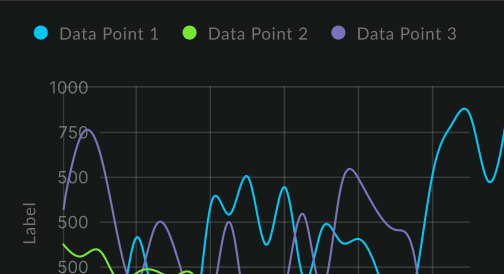

Valuation

Optimize your derivatives pricing and valuation with a solution that promises speed, scalability, and efficiency. Streamline every step of your valuation process, from trade capture to model validation, for a seamless, integrated portfolio management experience.

Market Risk

Transform your firm’s approach to market risk with the most comprehensive suite of analytics for a holistic view across the enterprise. Designed to empower users with on-demand insights, enabling more informed trading and risk decisions with advanced scenario analysis and stress testing capabilities.

XVA & Counterparty Risk

The industry’s most sophisticated analytics, enabling traders to manage counterparty risk exposures, integrate XVAs into deal prices, and execute even the most complex deals at the right price.

OTC Trading

From structuring and pricing to hedging, risk analysis, lifecycle management, and P&L attribution, our real-time infrastructure empowers issuers and distributors to seize market opportunities with confidence.

Structured Finance Trading & Risk

Customizable analytics, seamless integration, robust pricing, and precise risk management for your fixed income and structured finance portfolios.

Banking Asset Liability Management

Our Asset Liability Management (ALM) solution bridges the gap between portfolio economics and accounting, revolutionizing risk measurement and decision-making for fixed income portfolios.