FRTB: The Technology Considerations and What You Need to Know

FRTB (Fundamental Review of the Trading Book) represents the most significant market risk regulatory change in at least the last decade. This regulation set will manifestly change the way banks run their trading business and will require changes to the technology infrastructure that needs to support it as aging legacy platforms as are just not up to the task. So as the 2019 FRTB implementation deadline approaches, it is important for firms to know and understand the technology architecture needed to meet the new flexibility, agility, scalability and computational requirements.

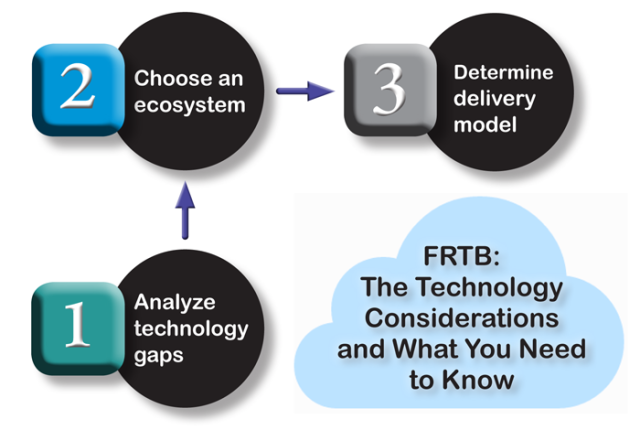

In this paper, Satyam Kancharla, Chief Strategy Officer at Numerix, discusses what he considers to be the necessary building blocks for banks to achieve the right technology infrastructure to enable successful FRTB implementation. He further emphasizes that having the capacity to meet the new requirements and adapt to the influences driving them can present significant opportunities.

This white paper examines:

- The challenges over tasked and often band-aided legacy technology faces when trying to meet the demands of FRTB

- New technology transforming banking and risk management

- The building blocks to achieve the right technology infrastructure to enable successful FRTB implementation

- How banks can go beyond meeting regulatory demands to realize opportunity from new technology architecture

Authors

Satyam Kancharla leads Numerix's product and engineering teams and guides corporate strategy. Since his inception at Numerix in 2003, he has demonstrated versatility in various capacities, ranging from Quantitative Software Development to Financial Engineering and Client Services roles. His international experience includes serving as the Chief Technology Officer for Numerix Japan in Tokyo, where he led the Pre-Sales and Financial Engineering teams for Asia before relocating to Numerix's headquarters in New York City.

Prior to joining Numerix, Mr. Kancharla made substantive contributions to Quantitative Finance and Product Development at prominent financial institutions like Merrill Lynch and GE Capital. His educational background boasts an MBA from New York University's Stern School of Business, an MSc in Applied Statistics and Informatics from the prestigious Indian Institute of Technology, Bombay, and a BSc in Mathematics and Computers from the University of Mumbai. Mr. Kancharla’s impressive career trajectory and academic acumen underscore his important role in steering Numerix's innovation and strategic direction.