LIBOR Transition Update: RFR Adoption So Far, & How Numerix Analytics Can Help

Find out how new Risk Free Rates (RFRs) have been adopted in derivatives markets around the globe, and learn how Numerix analytics can help firms price new RFR products, construct RFR curves, and build volatility surfaces.

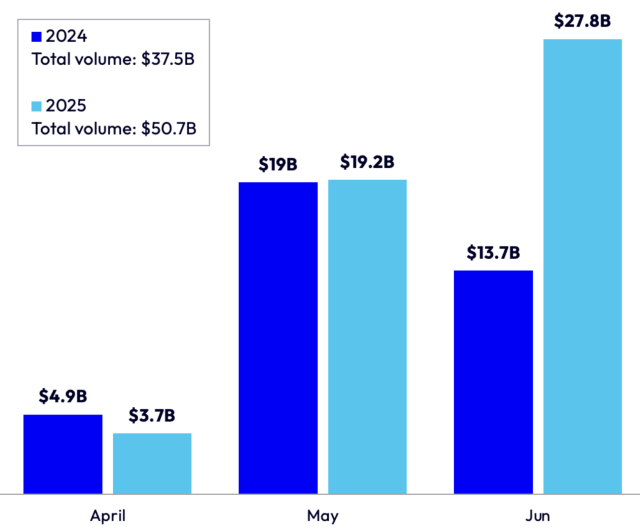

The LIBOR transition has happened – kind of. LIBOR’s cessation date of December 31st, 2021 has come and gone for most currencies and tenors, and the world has mostly moved on to new Risk Free Rates (RFRs), especially for new issuance. But market adoption of new RFRs has been somewhat slower than anticipated by many market participants and regulators, and adoption varies by jurisdiction.

Join Liang Wu of Numerix as he discusses the latest developments in the LIBOR transition, and how Numerix’s RFR analytics are helping firms manage their transitions to new RFRs.

Liang covers:

- Market update on RFR derivatives adoption

- Overview of Numerix RFR analytics

- Product coverage

- Curve construction

- Discounting curve

- LIBOR fallback curve

- LIBOR-to-LIBOR fallback transition curve

- Volatility surface updates

Featured Speakers

Liang Wu

Liang Wu is an Executive Director of Financial Engineering and heads up CrossAsset Product Management at Numerix. Wu has previously served as VP of Financial Engineering in the Client Solution Group at Numerix. Before joining Numerix in 2015, he worked at CME Group and HSBC in Pricing and Valuation, and Model Review roles. He holds an MSc degree in Financial Engineering from Columbia University, an MSc degree in Space Physics from Rice University and a BSc degree in Geophysics from University of Science and Technology of China.

Greg Murray

Greg Murray is responsible for increasing awareness of the Numerix brand in financial markets around the globe and contributing to Numerix’s strategic growth initiatives. Previously, he oversaw product and field marketing initiatives at the company, and he started his tenure in a sales role. Prior to Numerix, Mr. Murray worked in derivative analytics sales roles at other software firms, and he held derivative trading positions for seven years as an option market-maker and proprietary trader across a variety of asset classes.