Mortgage Servicing Rights (MSRs): A Promising Opportunity Area for Investors?

For investors looking to generate steady cash flow, investing in Mortgage Servicing Rights (MSRs) may be a strategic investment choice. While MSRs may not be as well-known as traditional fixed-income securities, they have gained traction among institutional investors aiming to diversify their portfolios and hedge against interest rate fluctuations.

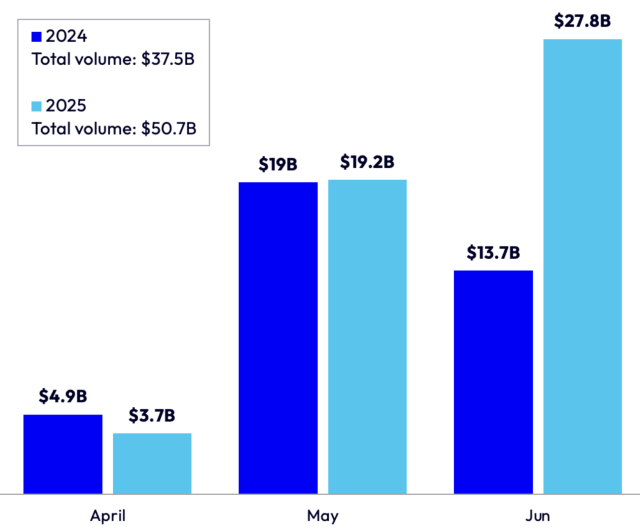

In 2024, the MSR market was robust, with trading volumes approaching the $1 trillion mark, a trend that is expected to continue into 2025. But how exactly do MSRs work? In today’s blog we’ll give an overview and explain the characteristics that may make them an attractive investment opportunity.

How do MSRs work?

MSRs are a unique asset class, representing the contractual right to service mortgage loans. When a mortgage loan is originated, the lender can choose to retain servicing rights or sell them to a third-party servicer. The servicer is responsible for collecting monthly payments, managing escrow accounts, handling delinquencies, and interacting with borrowers. In return, the servicer earns a fee—typically a percentage of the outstanding loan balance. MSRs can also be sold to a fund or real estate investment trust (REIT), which may then partner with a subservicer to handle the day-to-day administration of the servicing.

Beyond managing mortgage payments, servicers ensure taxes and insurance are covered and oversee loan modifications when necessary. Their compensation generally ranges from 25 to 50 basis points of the loan balance, reflecting their role in maintaining the loan’s performance.

Unlike mortgage-backed securities (MBS), which represent claims on the underlying loan principal and interest, MSRs are purely a cash flow asset—the investor does not own the loans themselves but rather the right to service them. This distinction makes MSRs behave differently from other mortgage-related assets, particularly in response to interest rate movements.

Why Investors are Taking Notice of MSRs

One of the most compelling reasons investors are taking notice of MSRs is their performance in rising rate environments. As interest rates rise, MSR values tend to increase due to lower refinancing activity. This trend contrasts with MBS, which decrease in value when rates fall, due to their bond-like characteristics.

Because the value of MSRs typically rise when refinancing activity slows, they provide investors with a natural hedge. Additionally, the fees earned from servicing create a consistent revenue stream, largely independent of broader credit market conditions. Even in periods of economic stress, homeowners continue making mortgage payments, sustaining cash flow to servicers.

Beyond cash flow stability, MSRs also offer diversification benefits. Their risk profile differs from traditional equity and fixed-income investments, making them a valuable addition to portfolios seeking exposure to alternative assets. Unlike bonds, MSRs can appreciate, providing a counterbalance in an investment strategy. In addition, because many MSR cash flow streams such as income from servicing fees and float income on P&I (principal and interest) and T&I (taxes and insurance) are interest-only (IO)-like, their performance is closely tied to interest rate movements rather than broader market trends, making them a strong diversifier in a portfolio. Their tendency to appreciate when interest rates rise provides a natural hedge against rate-sensitive assets like mortgage-backed securities and bonds. Financial institutions, particularly banks, also see MSRs as a capital-efficient asset. Given regulatory capital treatment under Basel III, some banks actively offload their MSR exposure, creating opportunities for non-bank investors to acquire servicing rights and benefit from the asset’s return potential.

Weighing the Risks

Despite these advantages, MSR investing comes with challenges. The most significant risk is prepayment, as borrowers refinancing or selling their homes shorten the lifespan of the servicing income stream. Because of this, MSR values are highly sensitive to prepayment speeds, which fluctuate based on interest rate cycles, borrower behavior, and broader economic conditions. Numerix’s PolyPaths helps mitigate this risk by quantifying prepayment sensitivities—such as option-adjusted duration and mortgage spread duration—while offering robust scenario analysis to assess potential market value impacts. This insight enables users to make informed decisions on hedging strategies to better manage their servicing book.

Another key area of consideration is cost due to delinquency. While higher interest rates generally benefit MSRs, a surge in delinquent payments due to rising rates can negatively impact their valuation. Thus, the ability to perform delinquency modeling is essential. Numerix's PolyPaths provides tools for fine-tuning prepayment and loss models, including transparency into the delinquency transition matrix, which models the probability that loans will become increasingly delinquent, eventually default, or return to a current status.

Additionally, servicing mortgages is operationally complex and heavily regulated. Investors acquiring MSRs must either have the infrastructure to service loans themselves or partner with external providers to manage the ongoing responsibilities. Shifting regulatory requirements also add a layer of uncertainty, as changes in consumer protection laws, foreclosure policies, or capital requirements can impact profitability.

Harnessing Technology for Managing MSRs

Given the complexity of valuing, managing, and monitoring MSRs, advanced risk technology plays a crucial role in supporting investors. Stress-testing tools enable investors to evaluate how macroeconomic shifts, regulatory changes, and market trends impact their MSR holdings. Meanwhile, portfolio optimization strategies help firms decide whether to retain, sell, or hedge their MSRs based on real-time market conditions.

For these reasons, a consistent framework for the valuation and hedging of MSRs is needed, such as that available in Numerix’ PolyPaths. Through offering capabilities for fine-tuning behavioral prepayments, delinquencies, and loss models, PolyPaths empowers market players to obtain an accurate view of their loan performance. In addition, Polypaths offers loan mapping and stratification, giving users the ability to import each individual loan and cohort them based on similar characteristics. This approach enables them to build a powerful yet manageable framework for running analysis.

MSRs: A Strategic Asset Worth Considering

MSRs offer a compelling investment opportunity for those seeking income-generating assets with interest rate sensitivity and diversification benefits. While they have some operational and regulatory complexities, sophisticated risk management tools enable investors to navigate these challenges effectively. As the market for MSRs evolves, institutional investors may increasingly view them as a strategic asset within a well-balanced portfolio. Whether as a hedge against falling bond values or a steady source of cash flow, MSRs are proving to be an asset worth considering.

Learn more about Numerix’s PolyPaths here.