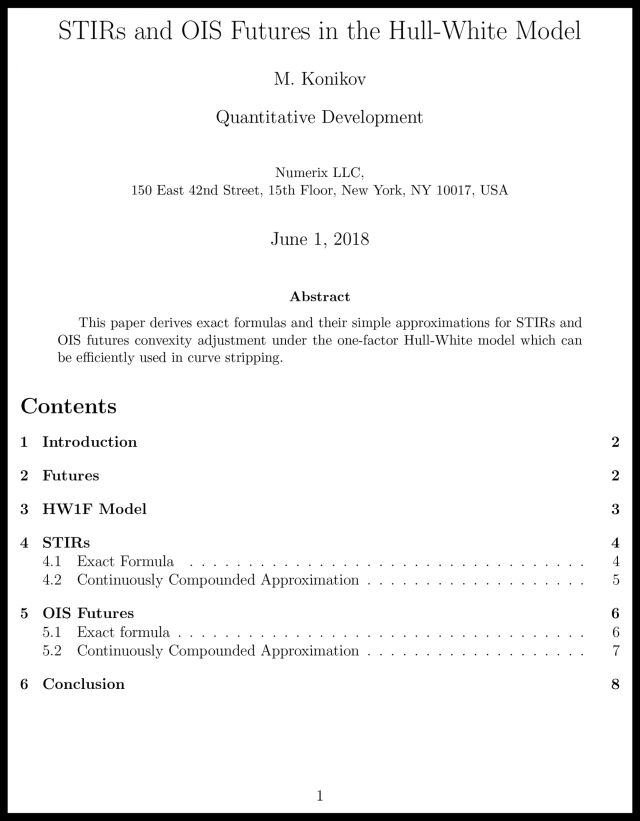

STIRs and OIS Futures in the Hull-White Model

This paper derives exact formulas and their simple approximations for STIRs and OIS futures convexity adjustment under the one-factor Hull-White model which can be efficiently used in curve stripping.

Complete the form to download this research paper, “STIRs and OIS Futures in the Hull-White Model”

This paper derives exact formulas and their simple approximations for STIRs and OIS futures convexity adjustment under the one-factor Hull-White model which can be efficiently used in curve stripping.

Complete the form to download this research paper, “STIRs and OIS Futures in the Hull-White Model”

Authors

Dr. Michael Konikov

Dr. Michael Konikov is a Senior Vice President and Head of Quantitative Development at Numerix, where he manages a team responsible for the development and delivery of models in Numerix software. Previously, he worked at Citigroup, Barclays, and Bloomberg in quantitative research and desk quant roles. He completed his PhD in mathematical finance at the University of Maryland College Park, concentrating in particular on the application of pure jump processes to option pricing. Dr. Konikov's publications cover diverse asset classes ranging from equity to interest rates and credit.