How Insurers Value Insurance Liabilities with Embedded Financial Guarantees

Many insurance firms offer insurance products that combine financial characteristics with optional living and death benefits. These products are attractive to customers, but ultimately introduce complexity into the contracts themselves.

From an insurer’s perspective, these are essentially sophisticated structured products with embedded options, and it can be challenging to value and manage the risk of these contracts. To address this issue, some insurers choose to develop in-house solutions for running valuations, while others turn to quantitative modeling experts for flexible, off-the-shelf software capable of accommodating these complex structures.

In a recent webinar, Valuing Insurance Liabilities with Embedded Financial Guarantees, Mario Bonino of Numerix showcased how Numerix’s CrossAsset software can be used to value liabilities with embedded financial guarantees, providing a specific example of a Guaranteed Minimum Death Benefit (GMDB) guarantee. In today’s blog, we provide webinar highlights and additional insight to accompany Mario’s technical presentation.

Offering Products with Embedded Financial Guarantees

Insurance products that combine financial characteristics with life insurance guarantees may be attractive to an insurer’s customer base, since they can essentially offer the benefits of two products in one.

From the insurance company’s perspective, the risks of guarantees need to be properly measured and managed. For example, these products may have long maturities that expose the insurer to long-term risks, for which hedging strategies can be difficult to implement.

Valuation and Risk Considerations

In his webinar presentation, Mario showed how a Numerix CrossAsset user can perform a range of analysis to address key areas like valuation, risk factor sensitivities and cash flow projections in Microsoft Excel®. These considerations are particularly relevant when designing a new product.

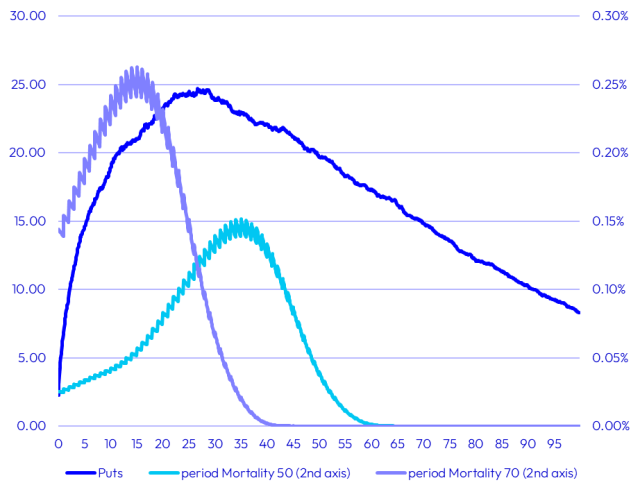

Chart: Guarantee decomposition

The chart above depicts an underlying “put” financial structure and death probability under two different policyholder age assumptions.

However, since the insurance company that is issuing these products also needs to value them and manage their risk over time, the workflow can be extended to value in-force policies and scaled using NxCore Cloud to leverage cloud computing.

Cloud-hosted computing resources enable insurance users to seamlessly scale calculations. As a result, risk figures for a realistic portfolio of insurance policies—comprising hundreds of thousands of products—can be generated in just a matter of minutes.

Benefits of Using Numerix

During the webinar demo, Mario showcased the flexibility of Numerix CrossAsset, which was highlighted in the vast range of analyses that users can run on their own in Microsoft Excel®, using the Excel add-in.

CrossAsset enables risk analysis in key areas insurers are concerned with, including sensitivities to financial and non-financial risk factors such as interest rates, mortality rates, lapse rates, premium fees, and more. In addition, the flexibility of Numerix analytics enables this workflow approach to be extended to other insurance products that have Guaranteed Minimum Benefit (GMxB) guarantees.

Get Deeper Insight

For further information and technical examples on this topic, please view our on-demand webinar: Valuing Insurance Liabilities with Embedded Financial Guarantees. In it, Numerix’s Mario Bonino outlines how to estimate the embedded guarantee’s value, project future cash flows and quantify sensitivities to risk factors.