white paper

The OIS & FVA Relationship: Evolution of OTC Derivative Funding Dynamics

This paper, written by Satyam Kancharla, Numerix Senior Vice President, explores the basics of OIS discounting and FVA for OTC derivatives—and then dives deeper into the relationship between the two concepts. The white paper also includes a case study that highlights the potential impact of FVA on trade profitability. The author concludes that FVA is a real charge that will affect the profitability of trades, and therefore, should impact decision-making about the trade. We come to see why it is imperative to know this cost in order to make the best business decisions.

Highlights include:

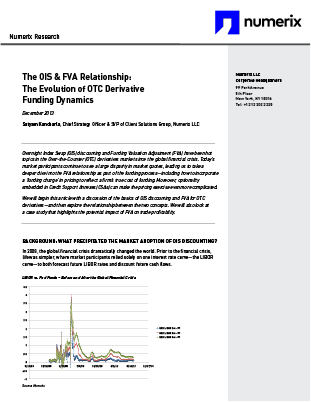

- What Precipitated the Market Adoption of OIS Discounting?

- Discounting and the Collateral Agreement

- Credit Support Annex Relationship and Real World CSA

- Why has FVA Recently Come to the Forefront?

- Effective Funding Rate and FVA as a Function of Threshold

- A Case Study: FVA Charges and Impact on Trade Profitability