-

Solutions

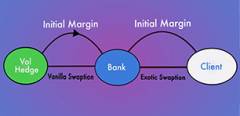

- Banking Comprehensive Derivative and Risk Analytics for Trading Desks and Regulatory Reporting

- Hedge Funds Derivative Pricing and Risk Analytics Supporting Opportunistic Trading Strategies

- Asset Management Analytics Enhancing Trading and Risk Decisions

- Fund Services

- Broker/Dealer Industry-Standard Derivative Analytics Supporting the Market Oversight and Economic Development Activities of Governments and Development Banks

- Government & Development Banks Analytics for Structuring New Product for Issuance and Managing Existing Obligations

- Insurance Helping Life and Annuity Businesses Better Manage Profitability, Capital, Risk, and Regulatory Compliance

- Advisory Comprehensive, Flexible and Transparent Derivative Pricing and Risk Analytics Supporting Valuations and Risk Advisory Work

- Software Firms Helping Technology Vendors and Consulting Firms Stay Abreast of Industry Changes with Flexible and Comprehensive Derivative Pricing and Risk Analytics

- Crypto Firms

-

Products

- Insights

- Partners

-

About Us

- About Numerix The Industry Leader in Cross-Asset Analytics

- Leadership

- Advisory Board

- Quantitative Advisory Board

- Awards View Industry Recognition of our Analytics Solutions

- Newsroom News and Press Coverage of Numerix Experts and Innovations

- Careers Do you have what it takes to be at the cutting edge of analytics? Learn about career opportunities

- Locations Contact Numerix Offices and Experts Around the Globe

- Numerix History