overview

Cutting Edge FRTB-SA Analytics From Two Industry Leaders

Deadlines for the Fundamental Review of the Trading Book (FRTB) regulations are rapidly approaching – is your bank ready? If not, we can help accelerate your FRTB Standardized Approach (SA) implementation and ensure your FRTB capabilities satisfy regulators.

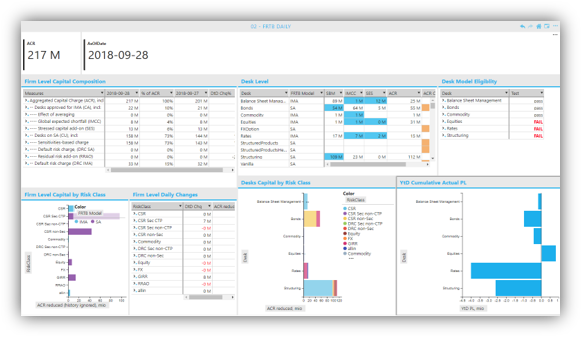

Numerix and ActiveViam, two leaders in capital markets analytics, have joined forces to offer a powerful end-to-end FRTB-SA solution. With fast calculations, customizable dashboards, and flexible in-memory analytics, you can get the answers you need in real-time to support capital optimization decisions and discussions with regulators.

capabilities

Comprehensive FRTB Functionality

The FRTB solution provides both a high-performance risk engine, Numerix’s Oneview for Market Risk, and an intuitive user interface with flexible in-memory data analytics, ActiveViam’s FRTB Accelerator, which contains all the FRTB business logic prescribed by the BCBS.

| |

Risk Engine

(Numerix) |

|

|

FRTB Business Logic & User Interface

(ActiveViam) |

|

Manages trades, market data, positions, calculation jobs, & business hierarchies |

|

|

Calculates all FRTB-SA capital requirements, & can consolidate results across multiple jurisdictions |

|

Generates risk sensitivities & buckets them as prescribed by FRTB |

|

|

In-memory data analytics provide flexible slicing-and-dicing of FRTB results for multi-dimensional analysis |

|

Handles extremely large & complex OTC derivatives portfolios |

|

|

Capital decomposition & incremental measures provided for deeper insights |

|

Cutting-edge models optimized for speed and accuracy |

|

|

Real-time data insights support “train of thought” analysis, capital optimization decisions & explanations for regulators |

|

Comprehensive market risk functionality, including scenarios, VaR, back-testing |

|

|

“What-if” analysis shows impact of new trades, changing book structure, or parameter changes on capital charges |

|

Key Differentiators

- Award-winning FRTB analytics

- Unparalleled real-time performance

- Intuitive & flexible interface

- Handles your entire portfolio, even complex OTC exotics

- Rapid deployments

|

Powered by the Cloud

The FRTB solution can be deployed on the cloud to take advantage of all the benefits the cloud can provide. This includes high performance, scalability, elasticity, and resilience, to handle the large and complex compute loads of firm-wide FRTB calculations quickly. The cloud also enables rapid deployment of the solution and faster upgrade cycles, to keep up to date with any changes that may occur over time with FRTB regulations.

|